UX/UI Design

Research

Design Sprint

For this design sprint I was the sole designer, it was my responsibility to connect with senior stakeholders, sales agents and customers to understand how we can use data to enhance experiences and drive sales.

Various Engineers

The supplemental health insurance company faced challenges in leveraging its existing data to drive sales and enhance customer experiences. Despite having a wealth of data, the company struggled to extract actionable insights and utilise data effectively.

This limited their ability to personalise offerings, improve customer satisfaction, and drive revenue growth.

To address these challenges, we conducted a six-week design sprint focused on exploring opportunities to utilise data to drive sales and improve the overall customer experience.

Objectives

01

Understand the customer and agent experience:

Through interviews and workshops, understand painpoints and identify opportunities by mapping out the experience for both customers and sales agents

02

Identify Data-Driven Opportunities:

Explore ways to leverage existing data to personalise product offerings, improve customer experiences, and drive sales

03

Enhance existing or create new platforms:

Design features for existing platforms or services, or create new solutions to drive sales

01

No "Self-Service" for group insurance customers. Forced to deal with sales agents

02

Policies often use complex language and can be difficult to understand if you need it / what it covers.

03

Many agents were leaving around the 1 year mark, citing complexities with selling to customers - impacting revenue

We interviewed sales agents and customers to understand the experience buying insurance policies, and also the experience of selling policies. This allowed us to map the journeys and identify any pain points which led to us brainstorming ideas for possible solutions.

Conducted user interviews with 4 Sales agents and 6 customers to understand the buying and selling experience with the company

We conducted multiple ideation workshops and working sessions with the wider team and senior business stakeholders. This allowed us to pitch ideas and get feedback quickly

Customer Insights:

No self-service online for insurance through work cover forcing users to go via agents

Policies are complex, difficult to know what they need

Not sure if they'd use the policy, "Why would I pay for something I won't need?"

Agent Insights:

Difficult to sell additional policies, customers apprehensive that they'll need them

Policies are complex and can be confusing for customers

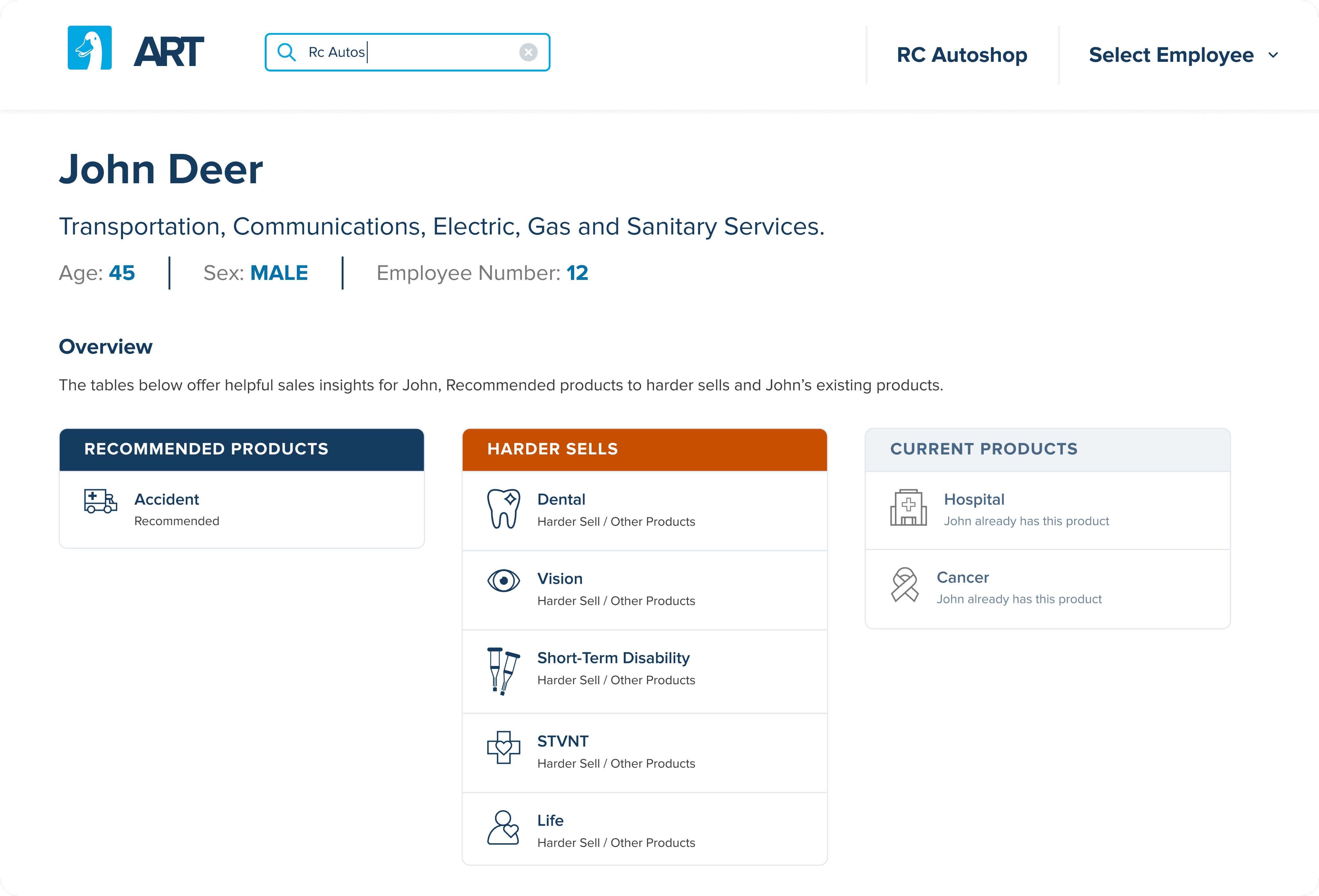

Feel as if they're going in blind to sales calls, not sure what to recommend / upsell

“It's for sure difficult to sell policies as a beginner agent, they're complex”

“I just don't know if I would use the policy, I don't want to pay for something I won't use"

“I really don't want to deal with a sales agent, if I could do it online I would”

Impactful statements from our interviews

Leveraging these insights we pitched 2 independent solutions, 1 for each persona. For the customer, focusing on clarity, self-service and personalisation utilising existing and new data. And for the Agent providing recommended policies for the customer based on customer data to help them upsell correctly and go into sales calls with confidence

01 Customer Solution

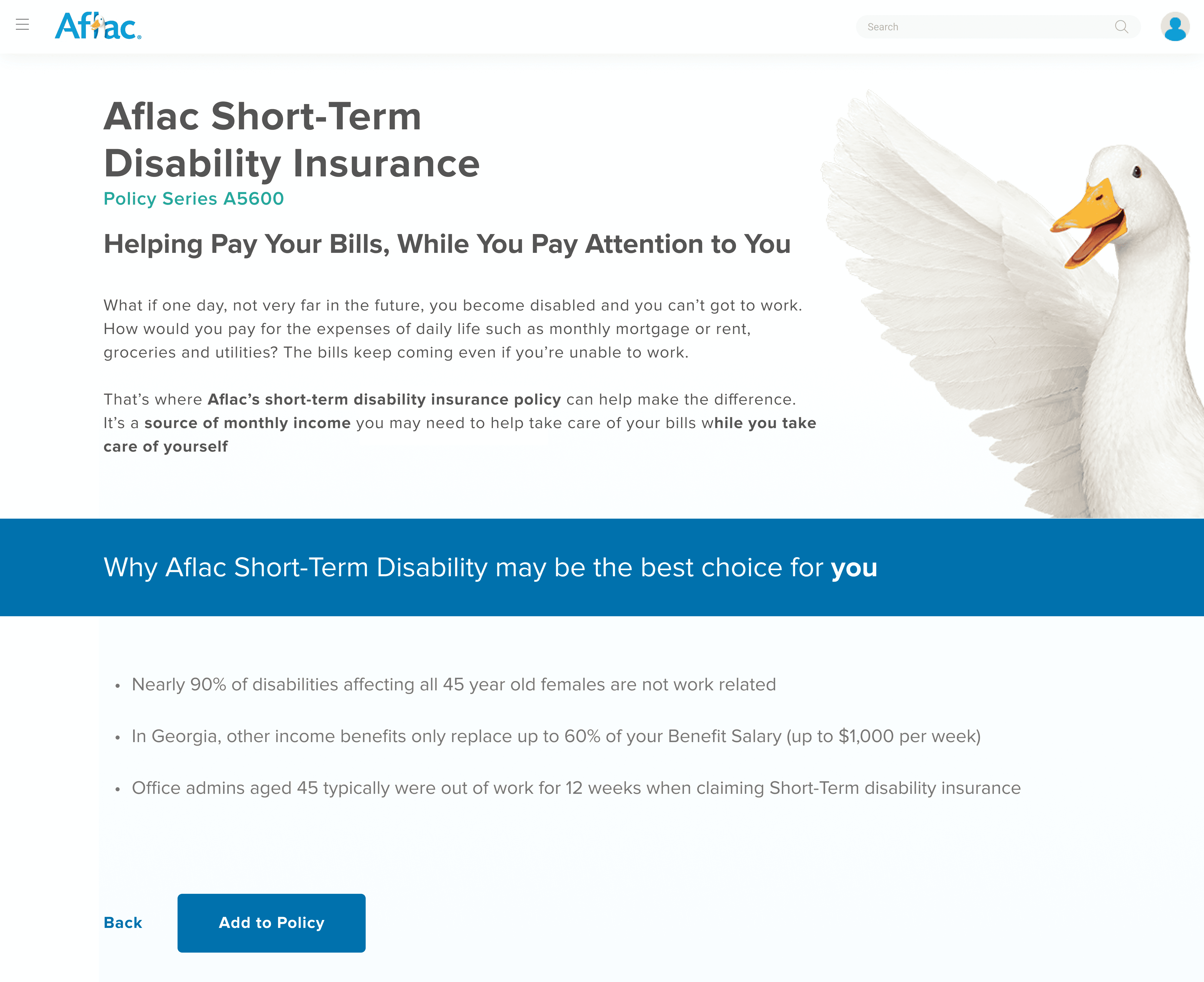

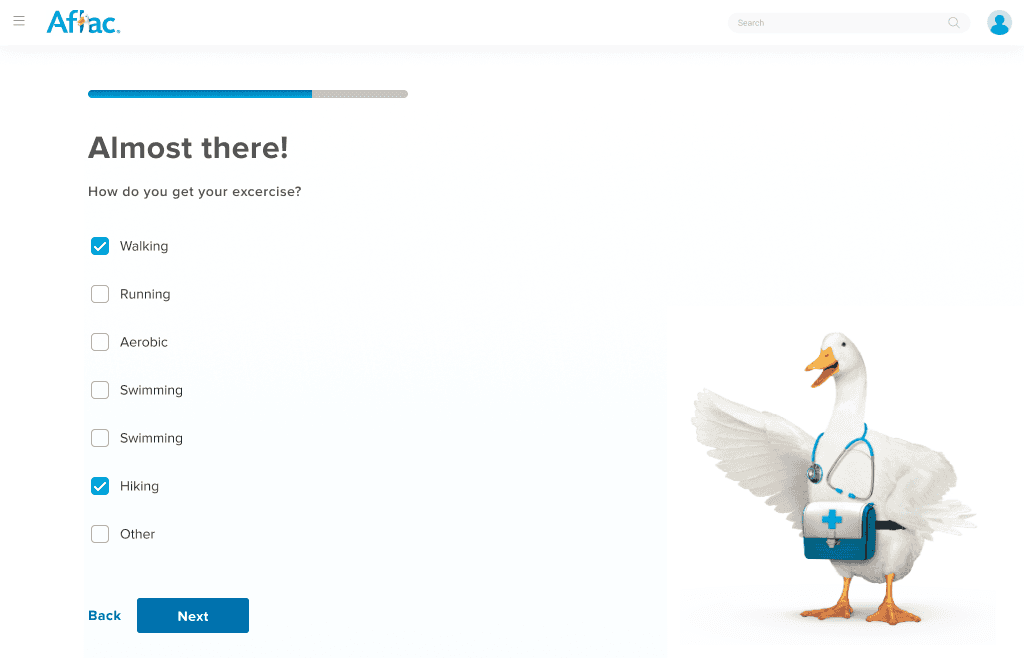

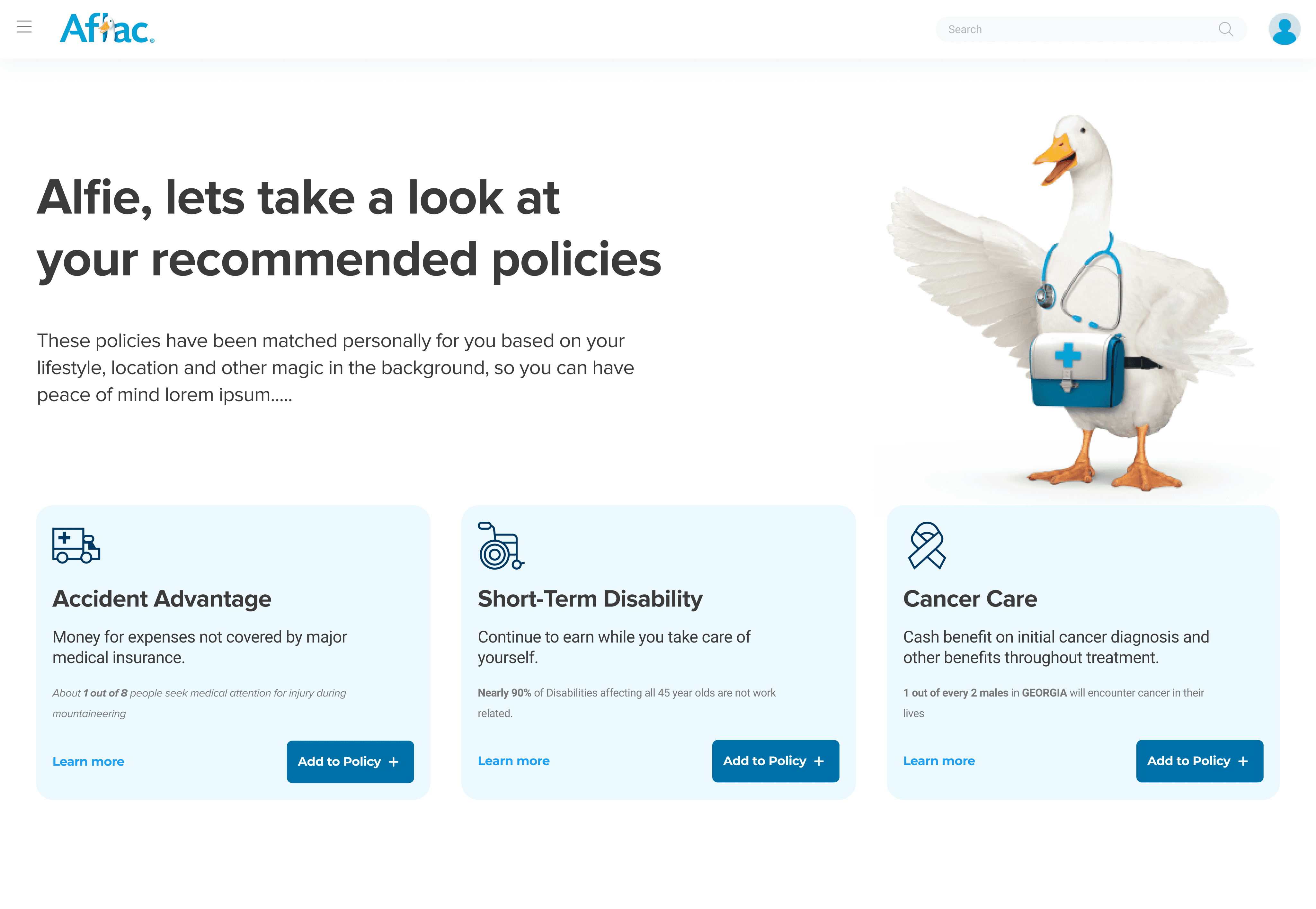

We designed a self-service platform for group customers which leveraged data to offer personalised insurance policies for the customer. By focusing on "recommended for you" we included stats to help reassure the customer that this policy would be beneficial as others similar to you have benefited from the policy type.

By offering them the ability to self-serve (with the option to call an agent) we provided choice for those who were dissuaded by agent contact.

oisinmckeever.com

oisinmckeever.com

oisinmckeever.com